How does sustainability affect raising capital? How do investment banks see sustainability when analyzing opportunities? What’s the point of view from venture capital firms? How does sustainability affect a business’ credit rating? This article looks at the current views from Standard & Poor’s, Toronto-Dominion Bank, MissionPoint Capital and others on this matter. We also look at what a business can do to attract capital.

How does sustainability affect raising capital? How do investment banks see sustainability when analyzing opportunities? What’s the point of view from venture capital firms? How does sustainability affect a business’ credit rating? This article looks at the current views from Standard & Poor’s, Toronto-Dominion Bank, MissionPoint Capital and others on this matter. We also look at what a business can do to attract capital.

At the conference on Environmental, Social and Governance (ESG) Issues presented by the Canadian Institute of Chartered Accountants (CICA), an audience of senior executives from Canada and around the world heard from an industry panel on the current state of how sustainability affects raising capital.

Bruce Cooper from Toronto-Dominion Bank’s Asset Management division shared the perspectives from an investment bank. On assessing the risks of an opportunity, TD wants to know how the company is dealing with carbon. ‘If carbon costs increase, how would this company respond? What is the impact to their business? We are interested in a company’s preparedness and governance on carbon, emissions, and environment.’

TD is the second largest bank in Canada and sixth largest in North America. When looking for green opportunities, TD does not focus on any particular sectors. ‘We want to invest in all sectors. But we want to invest in the sustainability leaders in those sectors.’

TD sources ESG data of companies from Asset4 (now owned by Thomson Reuters), Bloomberg, among other data service providers. TD also has an internal ESG analyst. ‘We use our own scoring matrix to see how a company ranks based on our criteria. We then provide those scores to our portfolio managers. Our focuses are more on the environmental and governance part of ESG. The social part attracts less attention.’

TD is part of the United Nations Principles for Responsible Investment Initiative (UN PRI). It is a network of international investors working together to put the six Principles for Responsible Investment into practice. TD’s sustainability funds have approximately $20 million and focus on sustainability investment opportunities. This contrasts with the point of view from a rating agency like Standard and Poor’s, whose focus is on risks.

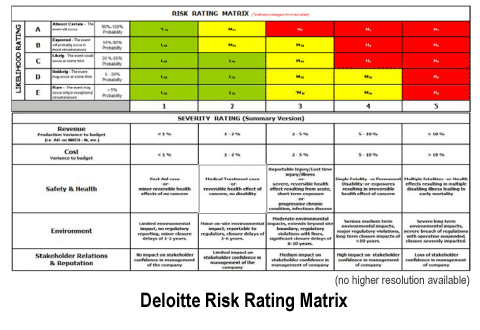

Mark Mettrick, Head of Standard & Poor’s Canada, shared the perspectives from a credit rating agency. ‘S&P starts with sectorial information, then zoom into company specific information. Currently S&P Canada uses two external consulting firms to collect and analyze the data. But the data is often not readily available. Most companies still do not measure emissions.’ S&P is one of the Big Three credit rating agencies in the world. Overall, Mettrick relates that at this point in time, ESG is not yet a major factor in rating. In evaluating sustainability risks, Deloitte Canada uses their Risk Rating Matrix (see diagram).

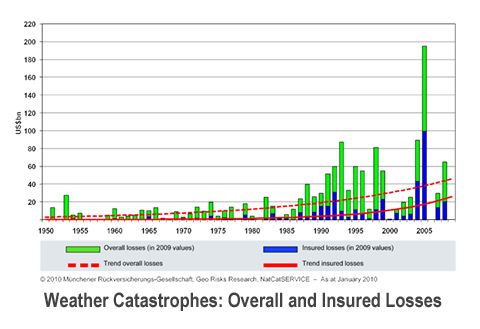

Martin Wittaker of MissionPoint Capital Partners, a private equity firm based in Norwalk, Connecticut, added his perspectives from a venture capital firm. Many businesses are not very aware of how they are impacted by climate change and extreme weather events. When a real estate project is delayed, flights are cancelled by airlines, or a shipment of consumer goods is damaged by weather events, they often attribute it to forces of nature and there was nothing they could have done about it. But with global warming, weather catastrophes are happening much more regularly than before. Annual losses due to extreme weather have been in the tens of billions range in recent years (see diagram below from Munich RE).

And the trend is going up. How a company deals with climate change factors and weather events are very important. Wittaker, who sits on the advisory board of Carbon Disclosure Project, said that ‘industries like real estate, insurance, and airlines are hugely impacted by climate change and weather events. Investors have to take that into consideration.’

Is your business emitting a lot of carbon? How are you dealing with your carbon emission risks? Some time in the future there will likely be a big price stamped on carbon. This may create a big cost that could reduce shareholder value. Investors, whether institutional or individual, are looking more and more closely on this. (See ‘Investors Increasingly Concerned With Climate Change Risks‘.)

If your business wants to attract capital, what should you do? What can you do in sustainability that can help you? Cooper’s advice is very simple. ‘Right now, TD is just asking for disclosure, such as reporting to the Carbon Disclosure Project. In the future we would like to see reduction. But right now, we think your business is great if you just disclose. So it is currently very easy to score high for TD!’

[…] This post was mentioned on Twitter by John Doss, Progressive Bloggers. Progressive Bloggers said: #cdnprog Investment Bank, VC, Credit Rating Agency Talk Sustainability (Carbon49): How does sustainability… http://dlvr.it/GBvzd #cdnpoli […]

It is great to have the opportunity to read a good & quality article with useful information.

Thanks

Wilson Kendy

“private equity china”

Glad you liked the article. Thanks for your kind words, Wilson!

[…] “Impact investing can provide good return on investment,” according to Julia Langer, Chief Executive Officer of Toronto Atmospheric Fund, a fund who has invested more than $50 million in local climate solutions and has helped Toronto save more than $55 million on its energy bills. “It’s not just about feeling good. But you need to know how to value it.” For more on how environmental, social and corporate governance (ESG) factors are valued by the financial industry, read my article Investment Bank, VC, Credit Rating Agency Talk Sustainability. […]